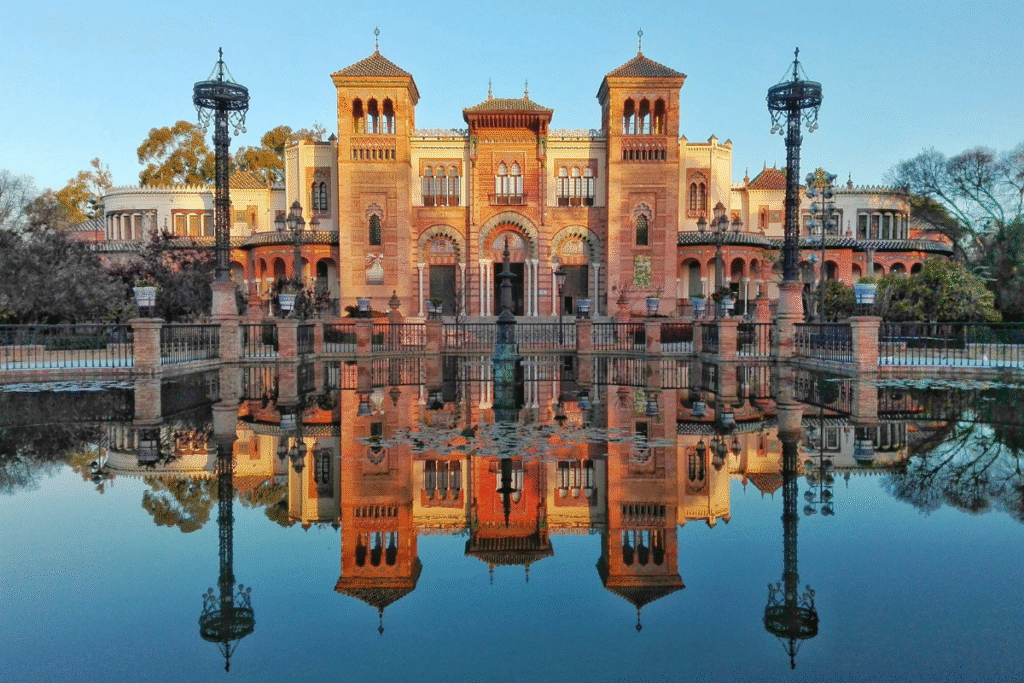

Spain’s new world debt swap hub represents the nation’s push for moral monetary reform. Credit score: Javibuiant on Pixabay through canva.com

Spain has launched a debt swap hub. It is a easy thought at its core. That is to assist poor nations cease sending cash overseas and spend money on their properties as an alternative. If the nation owes hundreds of thousands of debt to lenders, it may well negotiate the transaction the place the cash is redirected. As a substitute of constructing colleges, defending forests and making separate repayments to enhance entry to scrub water. Such a transaction is a improvement debt swap, and up till now it has been a uncommon and gradual course of. Spain desires to facilitate that transition with the help of the World Financial institution.

Sevilla’s new centre will function a hub for fundraising in addition to experience. There is no want to begin from scratch with nations you wish to strive, however how does it work? Who’s certified and why does Spain place itself at its centre?

What’s the alternate of debt?

If a rustic borrows cash from a authorities, financial institution, or an establishment just like the IMF, it often has to build up curiosity and repay the mortgage. Nevertheless, lenders might agree to chop or cancel the mortgage so long as the nation makes use of the cash for a selected goal.

It’s referred to as the alternate of debt. This consists of redirecting cash that has been paid. Please give an instance:

- The state owes 50 million euros to lenders and can conform to spend a few of that cash on forest conservation and constructing clinics as an alternative of paying the total quantity.

- Lenders settle for decrease returns and as an alternative assist one thing accomplish on the bottom.

These swaps have been round for many years and are pushed primarily by means of environmental buying and selling. Nevertheless, over the previous few years, nations comparable to Belize, Barbados and Ivory Coast have used them to fund marine conservation, schooling and even clear power. Collectively, these preparations generate round $6 billion worldwide.

They’re comparatively uncommon for causes, and every transaction requires attorneys, approval, monetary planning and supervision. This takes fairly some time and never all governments have the power to deal with it. That is the place assist comes and the way Spain fills that hole.

What Spain is launching

On July 1st, Spain and the World Financial institution formally opened a world hub for debt swaps. It’s at present based mostly in Seville and is meant to do issues that aren’t different centres. That is to make it simpler for the state to alternate it for funds for improvement tasks.

- Spain has dedicated 3 million euros to help the hub, and the World Financial institution oversees the technical features.

- It helps the nation arrange transactions whereas offering entry to the funding instruments it must handle and get began with paperwork.

That is the primary time the G20 nations have formally established a centre for one of these work. Spain has made minor exchanges previously, together with debt transactions in Latin America.

Seville held the UN funds for the Growth Summit concurrently, offering rapid visibility amongst ministers, lenders and UN companies.

New hub for debt swaps

The commerce of neatias with a small variety of debt I’ve already unlocked $6 billion worldwide. Belize was used to guard the reefs. Barbados restructured its debt in alternate for local weather adaptation funds. These weren’t one-off donations. These have been structured transactions that freed up actual funds areas.

- The Spanish hub is designed to repeat these transactions.

- International locations dealing with strict reimbursement deadlines might have various choices.

- Spend your cash transparently domestically with a framework backed by trusted establishments just like the World Financial institution.

As a substitute of strict repayments following emergency loans, nations have been in a position to commerce these obligations for funding at long-term worth. It is a monetary device, but it surely offers you a lot wanted respiratory.

Not all money owed qualify. International locations can solely negotiate exchanges Particular forms of loanstypically bilateral or concessional. Business debt, or debt owed to a number of establishments, is way more tough to restructure.

Spain’s 5.5 billion euro pledge

Earlier than launching the Debt Swap Membership, Spain had pledged to redirect EUR 5.5 billion IMF reserves to help low-to-middle-income nations. He additionally hosted the event of the United Nations and citizen funds. This gave coverage instruments a diplomatic platform fairly than only a monetary platform.

Spain will help by investing in repeatable constructions. This may be adopted by others and restructured the nation’s method to inexpensive debt.

Many nations are pressured to decide on as curiosity funds improve and world borrowing prices stay comparatively excessive Conservative debt and Spend on fundamental wants. That stress is turning into harder to disregard.

The brand new Spanish hub might not clear up that, but it surely affords an alternate that may flip a few of that stress into one thing extra handy with out ready for an entire overhaul of the worldwide system.