Based on the Federal Commerce Fee, People over the age of 60 misplaced an astounding $700 million in on-line scams in 2024.

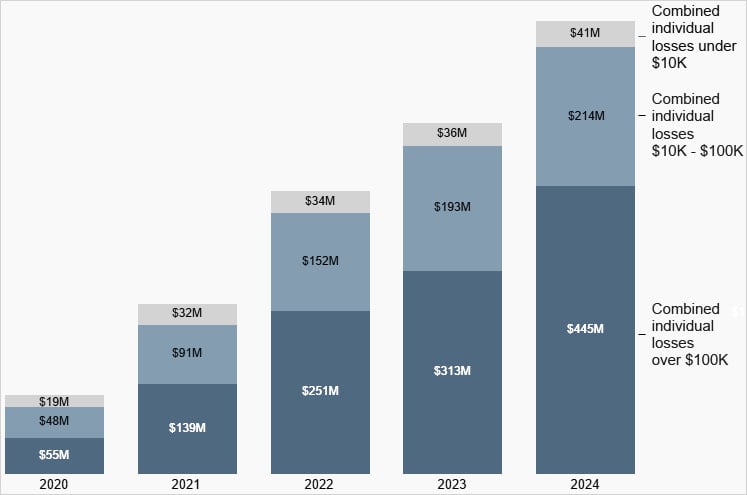

This diagram is featured within the newest from the company Shopper Safety Knowledge Highlightrepresents a rise over all three classes of losses in comparison with previous years.

Most notably, in comparison with 2020, individuals who misplaced greater than $10,000 have recorded eight occasions the quantity of losses jumped.

Under is an evaluation of the amount.

- Loss over $100 million: $445 million

- Lack of $10-100,000: $214 million

- Loss underneath $10,000: $41 million

The whole losses in 2020 had been $121 million, so the $700 million determine in 2024 represents a six-fold improve.

In comparison with the earlier 12 months in 2023, losses for individuals over 60 had been recorded, representing a big improve of round 30% in 2024.

Supply: FTC

Widespread fraud techniques

FTC Highlighted Consists of widespread fraud techniques concentrating on seniors in 2024, impersonation, false disaster eventualities and telephones.

The sufferer was informed lies that had been designed to create urgency, together with suspicious exercise in a checking account, social safety numbers concerned in crime, malware infections and laptop hacking.

The scammers had been disguised as authorities companies, together with FTCs, or firms like Microsoft or Amazon, providing to assist the goal on suspicion of points.

“In one other layer of irony, these scammers usually fake to be the FTC, the nationwide shopper safety company, and typically impersonate actual employees,” the FTC experiences.

“Reviews present that these scammers have informed them to switch cash from their accounts, deposit money in Bitcoin ATMs, and even hand over the stack of money and gold to courier.

The FTC has additionally continued to name whereas most of those scams are launched on-line, however many occasions, whereas in susceptible and remoted, they’ve been known as to extend strain and emotionally manipulate victims.

Aged individuals are usually focused by fraudsters resulting from their lack of entry to bigger monetary reserves, belief or respect for the authorities, and lack of information of the expertise.

The FTC says that in lots of circumstances, these individuals have misplaced their complete financial savings of life and even 401(ok), leaving them financially and emotionally devastated.

To remain protected from these scams, brokers suggest shifting cash and sharing monetary data with unknown callers and messengers. As a substitute, individuals ought to cling up and confirm by contacting the company or firm straight utilizing public contact data.

The $445 million misplaced in 2024 by individuals over 60 in 2024 is certainly a big quantity, however it pales compared to the entire misplaced by People in 2024 to fraud. It was $12.5 billion.

It is a file quantity, rising 25% in 2023, reflecting the continued improve in fraud losses for the reason that FTC started recording this information.